Horizon Business Consultancy’s VAT Consultancy and Compliance Services

UAE VAT Registration and Deregistration Services

VAT registration and deregistration are essential services for businesses operating in the UAE. Companies that meet the threshold of AED 375,000 in taxable supplies per year are required to register for VAT, while businesses with a taxable supply or expenses upto AED 187,500 are allowed to voluntarily register. Our experienced team of VAT experts can help businesses with the VAT registration process, ensuring that they comply with all the regulations and requirements of the Federal Tax Authority (FTA).

Similarly, we also provide VAT deregistration services to businesses that no longer meet the threshold requirements or have ceased operations. We can assist with the preparation and submission of all the necessary documents to the FTA, making the entire process hassle-free for our clients.

UAE VAT Return Preparation and Filing Services

VAT return preparation and filing is a crucial service for businesses in the UAE to comply with the tax regulations. It involves the preparation of VAT returns, which includes the details of sales, purchases, and input VAT paid and received during a specific tax period. These returns must be filed with the Federal Tax Authority (FTA) within the specified time frame, typically on a quarterly basis. Expert VAT consultants Dubai at Horizon Business Consultancy can assist businesses in preparing accurate VAT returns and filing them on time, reducing the risk of penalties and fines.

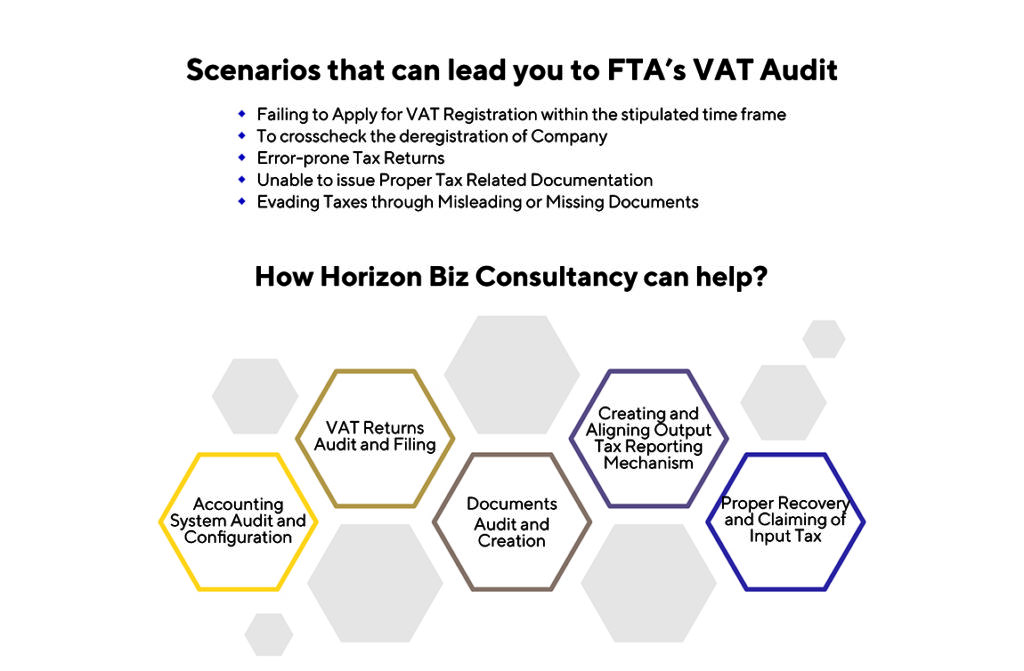

UAE VAT Audit and Assurance Services

At Horizon, our VAT audit and assurance services involve a comprehensive review and examination of a company’s financial records, transactions, and compliance with VAT regulations. It helps to ensure that the company is following the required VAT procedures and that all VAT liabilities are appropriately calculated and reported.

As authorized auditors, we are well-equipped to determine the accuracy of VAT returns filed, and to identify any discrepancies or errors that may lead to penalties or fines. These services you’re your business to identify and mitigate potential VAT-related risks and ensure compliance with UAE VAT regulations.

VAT Compliance Review and Support

VAT compliance review and support services involve reviewing and ensuring that a business is complying with all the VAT regulations and requirements set by the Federal Tax Authority (FTA). This includes verifying if the business is charging and collecting the right amount of VAT on their products and services, maintaining proper VAT records and invoices, and submitting accurate VAT returns on time. Our team of experts can help businesses identify gaps in their VAT compliance and provide support in rectifying them to avoid any potential penalties or fines.

VAT Training and Education Services

VAT training and education services by Horizon Business Consultancy, Dubai is series of hands-on workshop and knowledge training sessions. These are designed to provide businesses with the knowledge and skills necessary to understand the UAE VAT laws and regulations. These services can help businesses to improve their VAT compliance, reduce risks of penalties, and enhance their tax planning strategies.

Our VAT training and education services may cover a range of topics such as the fundamentals of VAT, VAT compliance procedures, record-keeping requirements, VAT treatment of specific transactions, and VAT implications for different industries. These services can be customized to meet the specific needs of your business and industry. We deliver these through various modes such as classroom sessions, online training, or workshops.

VAT Dispute Resolution and Representation Services

VAT dispute resolution and representation services involve helping businesses resolve any disputes or conflicts with the tax authorities related to VAT. This can include issues with VAT registration, filing, or payments. Our experts can assist in identifying the root cause of the dispute and strategize the best approach to resolve the matter in the shortest possible time.

Our experienced tax agent team can represent businesses before the tax authorities to resolve disputes, providing necessary support and guidance to ensure the best possible outcome. We aim to help businesses achieve compliance and avoid any penalties while ensuring their rights are protected throughout the process.

VAT Recovery and Refund Services

VAT recovery and refund services help businesses to reclaim the VAT paid on eligible expenses. Our team of experts can assist you in identifying eligible expenses, preparing the necessary documents, and submitting the VAT refund request to the tax authorities on your behalf. We provide end-to-end support throughout the VAT refund process, ensuring that your business receives the maximum refund possible while complying with all applicable laws and regulations.