End-to-End Support for CbC Reporting UAE

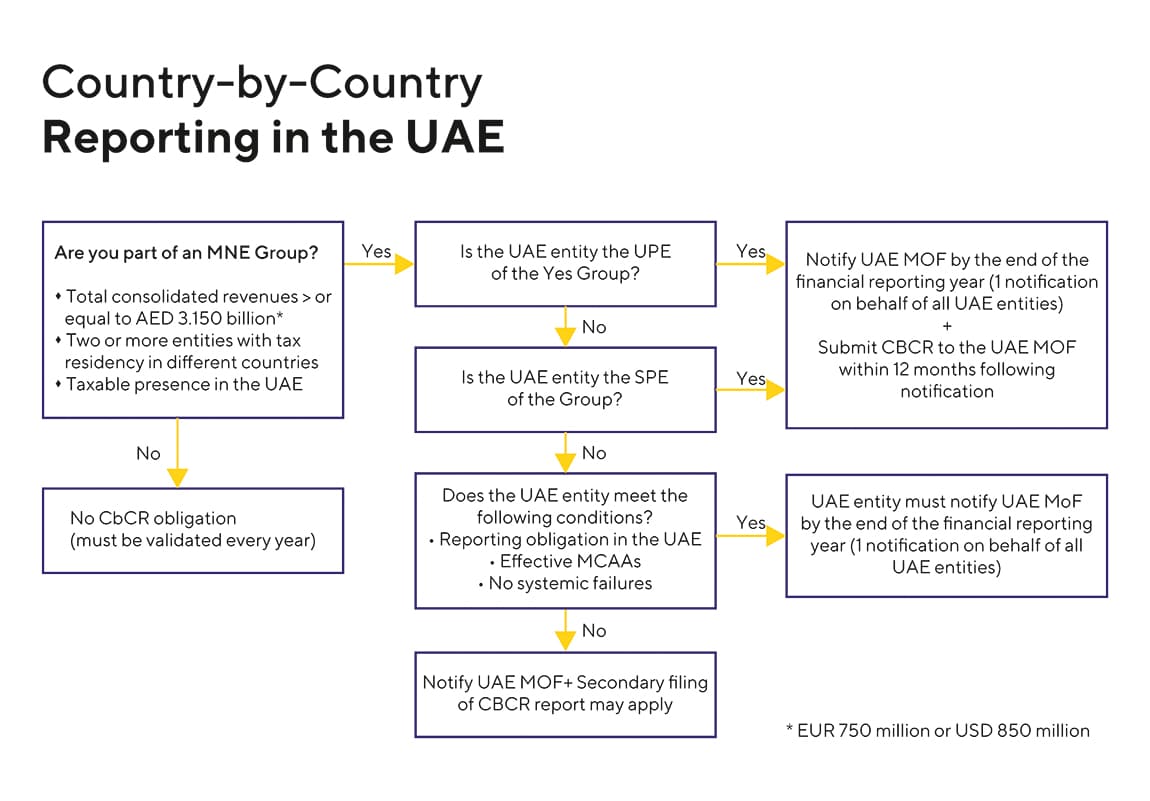

Large multinational entities are mandated to file a Country by Country (CbC) Report as per the Base Erosion and Profit Shifting (BEPS) Action 13, which includes an analysis of their global revenue, pre-tax profit, accrued income tax, and other economic parameters for each country where they conduct business.In the UAE, these CbC Report regulations apply to tax-resident organizations that are part of an MNE with combined revenues equal to or exceeding AED 3.15 billion (EUR 764 million / USD 858 million) in the financial year preceding the “financial reporting year” in question.

At Horizon Biz Consultancy, we understand that Large Multinational Enterprises (MNE) in the UAE need to comply with the Country by Country Reporting (CbCR) regulations. Our team of tax consultants can help you understand the CbC Reporting UAE requirements, conduct the necessary research to determine if your business operations fall within the restrictions, and assist you with compliance. We can help you file the required report with the competent authorities at the end of each financial year, ensuring that your business stays compliant with the regulations.