Experienced Account Outsourcing Services Dubai

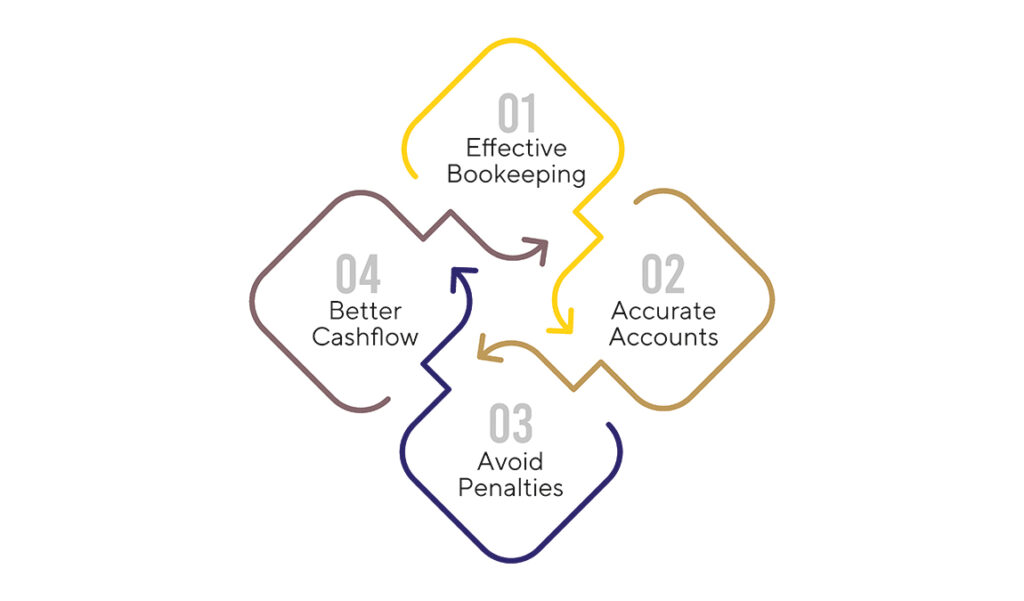

Outsourced accounting services when offered by a local Tax Consultancy firm such as Horizon Biz Consultancy can not only help your business in UAE save time, reduce costs but also improve financial management processes while enabling compliance protocols. Our Outsourced Accounting Services Include

Bookkeeping

We help you maintain accurate records of your monthly, bi-monthly, quarterly or annual financial transactions, including sales, purchases, receipts, and payments. In addition, we prepare meticulous financial statements, such as income statements, balance sheets, and cash flow statements.

Bank Reconciliation

We ensure that your company’s financial records are accurate and up-to-date, and that all transactions have been properly recorded. We also help identify any discrepancies or errors, such as missing or duplicate transactions, which can be corrected to avoid potential problems in the future.

Accounts Receivable Management

We help you streamline the process of invoicing, tracking payments, and collecting outstanding balances from customers so your cash inflows improve greatly.

Accounts Payable Management

We also assist you in streamlining the process of paying bills and other expenses, including vendor management, invoice processing, and payment processing and help you reduce the risk of errors so you can optimize your cash outflows.

Payroll Management

This includes managing employee compensation, including calculating salaries and taxes, processing payroll, and managing employee benefits. Horizon Biz Consultancy assists you with managing this process efficiently and ensuring compliance with local regulations.

Management Accounting or MIS Reporting

Performance reports are thoroughly evaluated of different departments to design and enable effective internal controls within the organization with the fulfilment of strategic objectives. It fosters strategic decision-making from the management.

Financial Analysis, Budgeting and Reporting

At Horizon, we help you analyze your financial data, derive insights, make streamlined budgets while preparing and consolidating reports to help you make informed business decisions. This can include preparing financial statements, budgets, forecasts, analysing MIS logs and other reports.

Tax Compliance

Our team takes your tax obligations seriously. We assist you every step of the way to prepare and file VAT and other corporate tax returns, manage tax payments, and comply with local tax regulations. In addition, we also support you to claim VAT rebates and assist you with the process.

Learn More