Our Audit and Assurance Services for Businesses in UAE

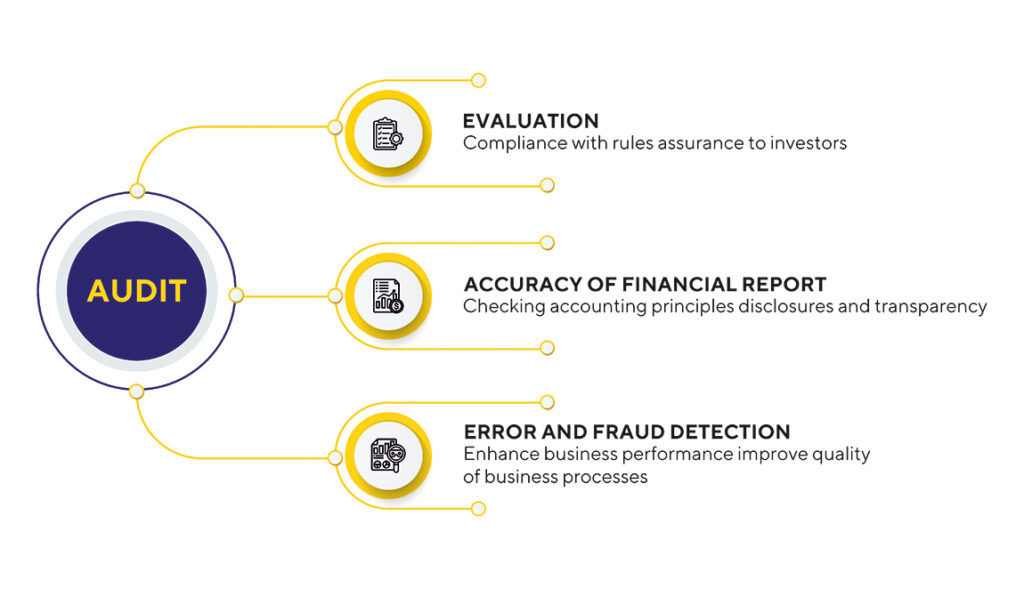

The shifting economic landscape in the UAE after the new Corporate Tax Regime on or after June 1, 2023, there is a need for audit and assurance services in the UAE to ensure that companies comply with new corporate tax laws and regulations in addition to an independent objective assessment of a company’s financial health and performance.

These services can also help companies identify potential risks and improve their overall governance and control processes. In addition, audits are often required by regulatory bodies or as a condition of obtaining financing or insurance.

To comply with these objectives, our services include

External Audits

Financial statement audits considering new corporate tax regime UAE 2023 involve the independent examination of financial statements to provide assurance that they are free from material misstatement and present a true and fair view of the company’s financial position.

Learn More

Internal Audits

Internal audits involve the assessment of a company’s internal controls, risk management, and governance processes considering the new corporate tax regime UAE 2023. Compliance audits ensure that a company is complying with relevant laws, regulations, and internal policies.

Learn More

VAT Audit

VAT Audit Services involve a thorough examination of a business’s financial records to ensure compliance with the UAE’s Value Added Tax regulations. These services help businesses identify and correct any errors or discrepancies in their VAT reporting, reducing the risk of penalties and fines.

Learn More

Review Engagements

Review engagements involve limited assurance engagements to provide a lower level of assurance than financial statement audits. Special purpose audits are tailored to the specific needs of a company and can include areas such as fraud investigations or due diligence.

Learn More

Operational Audits

We help your company examine the organization’s operational processes and procedures to evaluate their effectiveness, efficiency, and compliance with policies and regulations. The purpose of an operational audit is to identify opportunities for improvement. Once we explore such opportunities, we recommend changes that will help the organization achieve its goals more effectively.

Learn More

Diligence Audits

company is considering a merger, acquisition, or investment. We thoroughly assess the financial and legal risks associated with the transaction and to ensure that all material information has been disclosed.

The diligence audit includes a review of financial statements, contracts, legal documents, and other relevant information to identify any potential issues that may impact the value of the transaction.

Learn More

IFRS Advisory Services

IFRS is a globally accepted framework for financial reporting, and companies in the UAE are required to follow IFRS guidelines while preparing their financial statements. We offer IFRS (International Financial Reporting Standards) advisory services for companies to comply with IFRS guidelines and best practices.

These services may include IFRS training, gap analysis, impact assessment, and assistance in the preparation and presentation of financial statements according to IFRS guidelines

Learn More