Starting a company in a UAE free zone has perks like complete ownership and no corporate tax. But, these businesses still have important tax duties and rules to follow.

Let’s dig into this handy guide! We’ll look at taxes, what you need, and special rules when setting up a company in a UAE free zone.

What are Free Zones and How Do They Impact Taxes?

The UAE is home to over 40 free zones. These are special economic areas that operate under different regulations than the rest of the UAE and they hold a lot of appeal for foreign investors and entrepreneurs because of the benefits they offer, including:

- 100% foreign ownership of the business

- Exemption from corporate income taxes

- Ability to obtain visas more easily for staff and residence

- Streamlined business setup procedures

These benefits attract over 50,000 companies to establish in free zones across the UAE. But taxes aren’t eliminated entirely. There are still tax compliance regulations free zone companies must follow.

In this guide, we’ll cover:

One of the main advantages of establishing in a UAE free zone is the full exemption from corporate income tax on profits earned.

- Corporate income tax exemption details

- VAT registration requirements

- Payroll taxes and employee insurance

- Importing and exporting considerations

- Licenses and administrative fees

Companies located in the UAE that earn over 375,000 AED each year normally pay 9% tax on profits. However, this tax rate will rise to 20% starting in 2023.

But free zone companies pay 0% corporate tax on profits, regardless of the amount. This exemption is in place indefinitely.

For example:

With exhilaration and enthusiasm, it is declared that impressive profits of 1,000,000 AED have been achieved at XYZ Company’s onshore site. Nevertheless, abiding by tax regulations, the company is obliged to contribute 9% in corporate tax on any profits surpassing the 375k benchmark, totaling an amount of 56,250 AED.

ABC Company operating in a free zone also celebrates a successful profit of 1,000,000 AED. Their corporate tax amount owed is 0 AED. This exemption is in place indefinitely.

This demonstrates the significant tax savings a free zone provides. Activities exclusively within the boundaries of the free zone itself are exempt.

In some cases, a free zone company engaging in onshore or international transactions may incur partial tax liability. But operations solely within the free zone remain corporate tax free.

VAT Registration and Filing is Still Required

Although free zone companies are exempt from corporate income tax, they must still comply with Value Added Tax (VAT) regulations in the UAE.

It is mandatory for all companies operating in the UAE, including those licensed in free zones, to follow VAT regulations.

In 2018, VAT was implemented in the UAE with a tax rate of 5% on the majority of goods and services.

Free zone companies are required to register for VAT if their taxable supplies exceed the minimum annual revenue threshold of 375,000 AED.

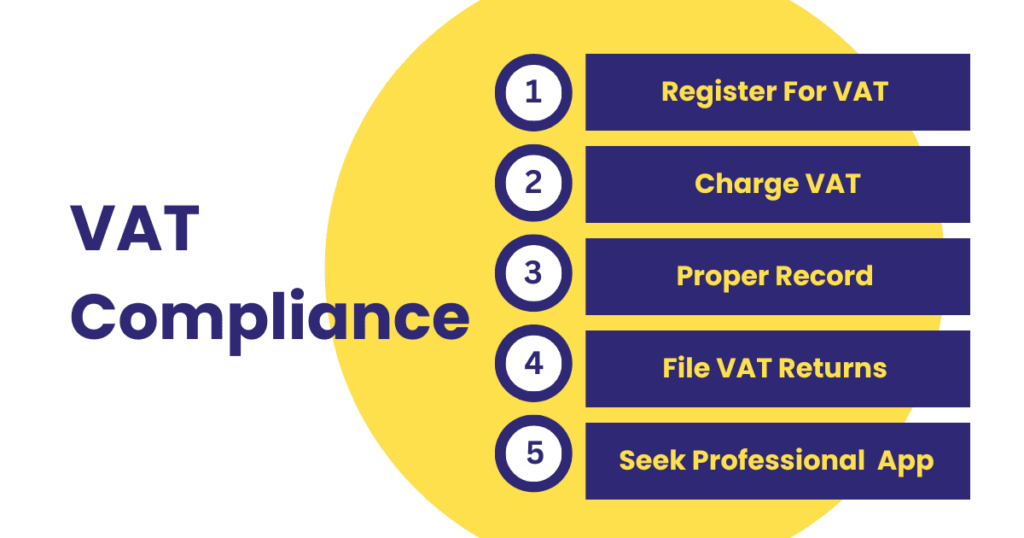

As a VAT registrant, free zone companies must:

- Charge 5% VAT on all taxable sales, goods, and services

- File periodic VAT returns

- Pay VAT amount owed to the Federal Tax Authority

- Maintain records such as sales invoices and receipts

This VAT reporting generates government revenue. Compliance is compulsory, even with the corporate income tax waiver.

Failure to meet VAT obligations can result in financial penalties from the FTA. Accounting firms can provide guidance on VAT compliance to free zone companies.

Payroll Tax and Employment Regulations

When a free zone company sponsors visas and employs staff, they must fulfill tax and employment regulations:

- Payroll income tax on employee salaries

- Social security contributions

- Health insurance contributions as mandated by law

These payments must be made on a per employee basis depending on their salary, nationality, and visa status.

Payroll taxes, health insurance, pensions, etc. still apply even though corporate tax is exempt.

Non-compliance can result in fines. Work closely with a payroll specialist to ensure you meet all regulations.

Importing and Exporting Goods

Importing goods into a UAE free zone or exporting internationally comes with some tax implications:

- Customs duties may apply on certain imported goods

- Free zones levy registration fees and import/export licenses

- Exports may be subject to taxes when leaving the UAE

Engaging an authorized customs clearance agent ensures compliance on cross-border transactions and movement of goods between free zones.

Even within free zones, transferring goods from one free zone to another can incur customs fees. Understand the regulations before importing or exporting.

Administrative Fees and Licenses

While free zones offer tax savings, companies do pay administrative fees and license costs:

- Free zone authority fees for company registration

- License fees ranging from 10,000 to 50,000 AED+

- Fees for visas, work permits, office space

- Renewal and amendment fees

Factor these costs into your budget and operations plan. Accounting firms can assist with license management.

Conclusion

We hope this detailed guide provided clarity on the tax implications for establishing a company in a UAE free zone. Please reach out if you need any assistance with accounting, VAT, payroll, or licenses for your free zone company. Staying compliant is crucial.

FAQs

No, free zone companies are fully exempt from corporate income tax in the UAE.

All UAE companies, including free zones, must register for VAT and file regular VAT returns.

Accounting firms like us specialize in free zone accounting, VAT, audits, and provide customized guidance on taxes.