Quickly, Dubai has turned into a world-class hub for tech and startup scenes. A big piece of this puzzle is the Dubai Silicon Oasis (DSO). It’s a unique free trade area built just to help technology, digital, and media firms from everywhere.

Boasting modern smart office areas, in-house skills training schemes, investment options and rules that promote business, DSO provides a winning atmosphere. Use this easy-to-follow guide to register and start your ideal tech company there.

Why DSO is the Right Choice for Your Tech Startup

DSO was developed by the government specifically to meet the infrastructure and operating requirements of startups and tech enterprises from around the world. Some standout benefits:

- Zero Taxes: Unlike mainland Dubai, the free zone offers a 0% tax scheme – there are no personal income taxes, and no withholding taxes, but 9% corporate taxes to be filed annually. This enables businesses to optimize and re-invest profits back into growth.

- Access to Capital: Between government innovation funds like the Mohammed Bin Rashid Fund, active private VCs & angel investors present onsite, accelerators and crowdfunding platforms, financing is highly accessible for companies at various stages.

- Plug-and-Play Infrastructure: DSO itself features grade A fitted-out office spaces, retail areas, residences, schools, hospitals and more within its high-tech park premises. Companies additionally get access to 20+ R&D centers run by Fortune 500 tech firms, data centers, 100+ network service providers and more. This self-contained ecosystem minimizes initial set-up and logistical hurdles.

- Business Support Programs: Government bodies like Dubai SME offer specialized entrepreneurship training programs and financial incentives exclusively for DSO companies. On-site tech incubators and accelerators also connect startups to mentorship, networking opportunities and growth tools.

- Business Ownership: Within DSO, 100% foreign ownership is permitted without needing Emirati/local partnership. This gives founders complete control and flexibility over strategic and operating decisions.

- Swift Visa Issuance: Work/residency permits can be readily obtained for staff and founders along with families. The process is streamlined and expedited compared to mainland Dubai.

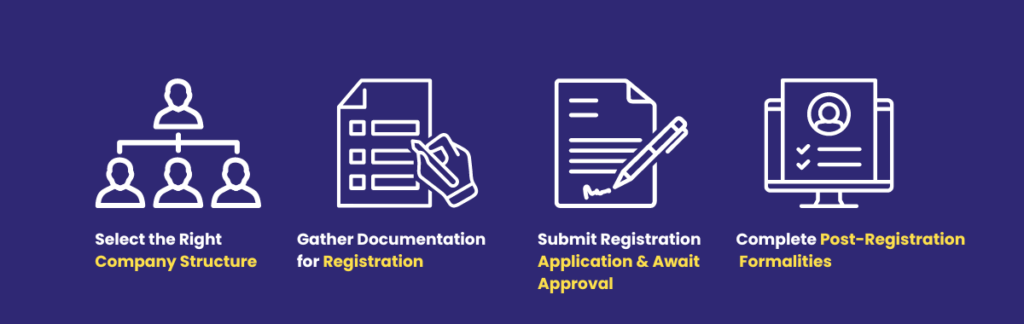

Step-by-Step Process for Registration & Set-up

Follow this playbook to seamlessly register and establish operations for your tech/digital business within DSO

Select the Right Company Structure

You can set up your company as:

- Free Zone Limited Liability Company (FZ LLC): Most popular due to 100% foreign ownership allowance and no taxation. Ideal for service-based IT/tech companies. Requires only one shareholder and director.

- Branch Office: Easy to establish for companies with parent operations in another country. Not an independent entity, but advantages include no paid-up capital or ongoing auditing requirements.

- Mainland Entity with DSO Branch: For existing UAE-based companies looking to expand into the tech space or leverage DSO incentives. Needs Emirati/UAE partner ownership.

Each structure has specific laws for business activities, capital needs, ownership proportions, compliance frameworks and more. Consult experts to pick the optimal one aligned to your offerings and expansion plans.

Gather Documentation for Registration

To proceed with DSO registration, first secure the following:

- Entry Permit from DSO’s Commercial Client Service Department

- Initial Approvals if required for certain regulated activities like fintech, education, media etc.

- Trade Name Reservation letter after verification of name uniqueness

You’ll also need to submit items like:

- Founders’ Passports

- No Objection Certificates (NOCs) from sponsors if applicable

- Notarized & Legally Translated Documents as per requirements

Submit Registration Application & Await Approval

Submit all documents along with the company registration form and await approval. Relevant free zone and government fees apply:

- Timeframe: 4-6 weeks

- Cost: 20K AED to 75K AED depending on company structure

DSO makes the entire application process highly streamlined through investor services and on-site representatives.

Complete Post-Registration Formalities

Upon approval, ensure these post-registration steps are completed before operations commence:

- Secure Office Space: Whether you opt for plug-and-play smart office packages or set up your own office, securing commercial space within DSO is compulsory to activate your trade license. Virtual offices do not fulfill requirements.

- Apply for Residency Visas: Obtain long-term work/investor visas for yourself, co-founders, employees and sponsored dependents. DSO facilitates speedy approval compared to mainland Dubai.

- Open a Corporate Bank Account: On presenting your DSO license, banks can facilitate account opening and issuing corporate cards quickly. This enables managing finances and operations seamlessly.

- Hire Specialized Staff: Work with a dedicated PRO consultant from the outset for compliant company incorporation, HR, accounting, visa and overall license management. Then focus on developing your core team.

Expanding Your Established DSO Business

Once set up, DSO provides unmatched support for ambitious growth:

- Access Additional Licensing & Visas: Based on your growth, obtain additional facility/activity licenses along with extra visa allotments and sponsored certificates.

- Launch New Ventures: Create new establishments for fresh concepts under the same founder umbrella brand via franchising or multi-license holding models in DSO.

- Add More Founders & Investors: Easily undertake changes in ownership proportions to add partners, shareholders and new funding routes as you scale.

- Leverage Dubai’s Extensive Treaty Network: Capitalize on the city’s favorable double-tax avoidance agreements when expanding overseas.

DSO also enables leveraging incentives, global networking channels and other unique opportunities for market expansion through associations with regulatory bodies like Dubai SME.

With blanket government backing and comprehensive ecosystem support, DSO offers the ideal launchpad for creating globally scalable, powerhouse tech companies out of Dubai to disrupt worldwide markets.

Conclusion

Within a mere 20 years, Dubai Silicon Oasis has developed into a formidable free zone ecosystem catering to pioneering companies from across the world. It represents the realization of UAE’s vision to drive technology innovation and progress globally.

Already, thousands of enterprises focused on creating the future through bleeding-edge hardware, software, AI, IoT and digital solutions have chosen to call DSO their strategic home base and springboard for unprecedented growth.

Its unique business advantages and regulatory framework makes the seeming implausible within arm’s reach. Company valuations that appear unrealistic to venture capital firms worldwide today, become norm in DSO’s high-velocity launchpad tomorrow.

Revolutionary ideas and technologies that investors dismiss as ahead of their time find fertile ground to disrupt and uplift industries here. Businesses with global domination dreams conceive market-shaping reality going from strength to phenomenal strength in DSO.

FAQs

You will likely need a no-objection letter from your existing sponsor/government, legal translations, and attested documents. Requirements vary for each country. DSO facilitators help verify and prepare all paperwork.

DSO offers plug-and-play smart office solutions starting 80 sq. ft. But you can also acquire larger customized offices and even tech-enhanced warehouses as per business activities.

No, you can leverage talent from across Dubai or other Emirates by securing employment visas for them as per quota eligibility.

No local sponsor/service agent is needed if registering as a 100% foreign owned FZ LLC entity within DSO. Sponsorship requirements apply for mainland companies.

Yes, both individuals and existing DSO companies can open multiple ventures within the free zone via additional licenses, franchising etc.