Running an online shop involves substantial costs. As a digital shop owner, it’s key to make the most of your tax reductions. This decreases your taxable earnings and brings down your tax payments.

In this detailed manual, we’ll delve into the top tax write-offs available for digital businesses. With the right record-keeping and bookkeeping, you can deduct thousands in approved business costs yearly.

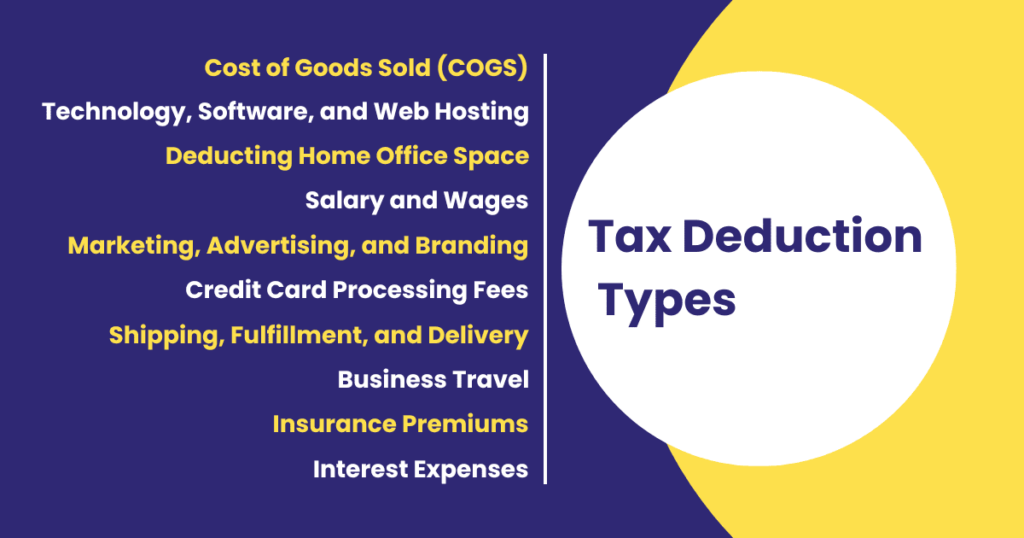

A Brief Overview of Digital Business Tax Deductions

First, let’s cover the basics – what exactly are tax write-offs?

Tax write-offs are costs for your business that you can take away from your total yearly income. This cuts down your taxable earnings. More write-offs mean a smaller taxable income and thus, lower taxes to pay.

For example:

- Gross Revenue: $200,000

- Expenses/Deductions: $80,000

- Taxable Income: $120,000

Selling online means your ecommerce business has many possible deduction types. Using the right deductions method, your tax cost can be nicely reduced.

Well-managed tracking, recording, and arranging of all your business expenses will do the job. This piece informs you about beneficial tax write-offs for online trade.

Cost of Goods Sold (COGS)

The best tax reduction for online businesses is the cost of goods sold (COGS). This covers the clear costs of making, buying, and getting products ready for sale to customers.

For online sellers, COGS expenses commonly include:

- Wholesale cost of inventory

- Shipping fees on incoming inventory

- Import duties and tariffs

- Warehouse rental for storage

- Packaging materials like boxes, labels, tape

- Damage, defects, and obsolete inventory

Any cost directly tied to acquiring or producing the products you sell to customers is deductible under COGS. Keep detailed records of all inventory purchases and related expenses.

Tracking COGS allows you to deduct these costs from gross profits, significantly reducing taxable income. For e-commerce businesses, maximizing this deduction offers huge tax savings.

Technology, Software, and Web Hosting

Running an online store necessitates major investments in software, web hosting, and other technology. These expenses are 100% deductible:

- Website hosting fees

- Domain registrations

- Ecommerce software platforms like Shopify

- Subscription software like accounting, analytics, or inventory management tools

- Cybersecurity and antivirus software

- Computers, laptops, tablets, printers, and associated equipment

Always keep tabs on all costs related to technology. For an online business, these probably make up a big chunk of your overheads. Cutting these expenses lowers profit that’s taxable.

Deducting Home Office Space

Many ecommerce businesses operate from a home office space. If this applies, you can deduct a portion of household expenses like:

- Rent or mortgage interest

- Homeowners insurance

- Gas and electric bills

- Repairs and maintenance

- Property taxes

- Security system fees

- Cleaning costs

- Renters insurance

Calculate the percentage of your home used for business activities, and deduct that portion of the above expenses. Keep detailed records showing the business square footage compared to total household square footage.

Salary and Wages

Labor costs involved in operating your ecommerce business are deductible, including:

- Salaries and hourly wages paid to employees

- Commissions, bonuses and incentive payments

- Contract labor and temporary hires

- Payroll taxes like employer paid FICA

- Employee benefits like health insurance contributions

- Retirement plan contributions like 401k matching

Issue 1099 forms to any contractors to document their compensation. Keep detailed payroll records for all personnel.

Marketing, Advertising and Branding

Web-based merchants spend a lot on promotional efforts to boost visits and purchases. Deduct these expenses:

- Pay-per-click (PPC) ads like Google Ads

- Social media advertising

- Email marketing software and subscriptions

- Influencer marketing fees

- Photography and videography for brand assets

- Graphic design work for branding

- Content marketing like blogs, eBooks, guides

Obtain invoices or issue 1099s to creators/influencers. Keep copies of all paid advertising invoices and campaigns.

Credit Card Processing Fees

The transaction fees paid to your e-commerce payment gateway provider are deductible. This includes fees like:

- Payment processing on transactions

- Monthly gateway subscription fees

- Chargeback fees

- PCI compliance fees

Keep monthly statements showing all credit card processing costs.

Shipping, Fulfillment and Delivery

Order fulfillment costs are deductible for e-commerce businesses:

- Packaging like mailers, boxes, tape, labels

- Postage and shipping fees via USPS, UPS, FedEx, etc.

- Monthly warehouse rental fees

- Pick, pack and ship fees at fulfillment centers

- Local delivery fees

Maintain through records of all fulfillment-related expenses. This can include keeping packing slips, postal receipts, invoices from fulfillment centers, and shipping carrier invoices.

Business Travel

Travel costs related to your e-commerce business are deductible. This includes expenses like:

- Airfare

- Lodging and hotels

- Rental cars

- Taxis, trains, buses

- Meals while traveling

- Luggage fees

- Parking costs

- Tolls

Document your travel expenses with detailed receipts and itineraries. Only domestic travel counts.

Insurance Premiums

Insurance plans to mitigate ecommerce risks are deductible, such as:

- Product liability insurance

- Errors and omissions (E&O) insurance

- Cyber liability insurance

- Business owner’s policy (BOP)

- Health/dental insurance for employees

Keep copies of premium invoices and payments.

Professional Services

Deduct any fees paid for:

- Accounting, bookkeeping or tax prep services

- Legal counsel

- Trademark and patent registration

- Payroll administration services

Save invoices and engagement contracts from service providers.

Interest Expenses

If you take out a business loan or use a business credit card, the interest is deductible. Keep detailed statements to differentiate personal vs. business interest.

Maximize Savings with E-commerce Tax Deductions

As an e-commerce owner, reducing your taxable income through deductions directly boosts profitability. Follow the tips in this guide to capture all eligible write-offs while maintaining proper documentation.

With the right deductions strategy, you can save thousands in taxes each year. Work with an accountant to identify any additional deduction opportunities specific to your online business.

Conclusion

As an e-commerce business owner, maximizing your tax deductions is a crucial step towards boosting profitability and minimizing your tax burden. By understanding and leveraging the various deductions available, you can significantly reduce your taxable income and keep more of your hard-earned revenue.

From the cost of goods sold (COGS) to technology and software expenses, home office deductions, marketing and advertising costs, and much more, this comprehensive guide has provided valuable insights into the numerous tax write-offs that e-commerce businesses can take advantage of.

FAQs

Keep receipts, invoices, bank/CC statements, bookkeeping ledgers, and any other proof of eligible business expenses. Digitize records for easy access.

Travel, meals & entertainment, cell phone use, insurance, and wages are often under-reported or missed.

Consult an accountant from the beginning to identify all allowable deductions. Have them help file your taxes fully leveraging write-offs.